You need to increase your wealth by at least 5x the rate of inflation, every year, just to get ahead.

This is a bit of a complicated topic, so I’m going to try to explain it to myself here so that I can explain it to you.

You are a citizen of the good old U.S. of A. You like your country. You like the people. You generally trust that the government does the right thing.

The U.S.A. has a currency, the U.S. Dollar.

What is a currency? It’s meant to do 3 things-

- Serve as a medium of exchange, i.e. I give you 4 dollars, you give me a coffee

- Be a unit of account, a way to measure relativity

- Be a store of value

You earn money and accumulate savings in Dollars because that’s the only choice you have. And you trust that it does what it says it’s supposed to do.

But does it?

1- You can buy coffee, or cars, or shoes with Dollars, so it does serve as a medium of exchange.

2- Coffee is $4+. New cars are $30k+. Shoes are $50+. You can use Dollars as a way of comparing prices, so it does work as a unit of account.

3- Is it a store of value? I’m not so sure about that one.

If today Coffee is $4.

Was it $4 10 years ago?

No, it was $2.

Wait a minute, how is that possible? If a Dollar is a store of value, then $2 should be me a Coffee for that price forever. Right?

A Dollar should be worth a Dollar forever. Isn’t that what being a store of value means?

Let’s come back to that question and look at how money works in the U.S. of A.

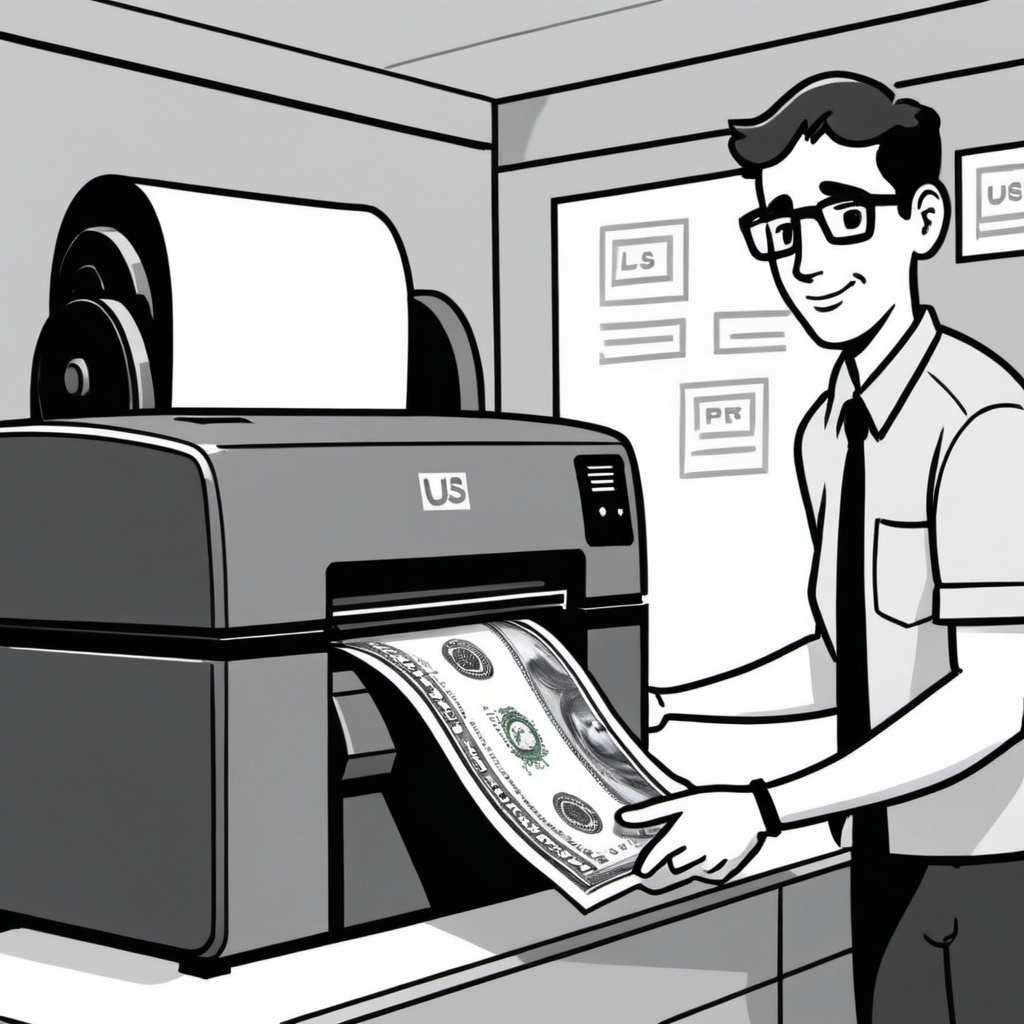

Dollars are printed by the U.S. Treasury.

Those Dollars are ordered from the U.S. Treasury by the Federal Reserve and then sent to banks.

How does the Federal Reserve pay for those Dollars? Are they free money? Well, it’s complicated.

You see, the U.S. Treasury also issues debt in the form of bonds, bills, and notes (all different names for the same thing, just different lengths of time).

So the Treasury sells me a $1,000 note, promising to pay me back in 5 years and it will give me some interest twice a year for my troubles. I give the Treasury $1,000, so in essence I’ve just loaned the government my money. The Treasury takes my $1,000 and pays its bills.

In 5 years, the Treasury gives me my $1,000 back. Where does it get the money? It does one of two things, or a combination of both.

It turns on the printer and it prints out $1,000. Or It borrows it from someone else by issuing another note for $1,000. Or it prints $500 and borrows $500. Something feels a little off about this, doesn’t it?

So great, now it’s 5 years later and I’ve got my money back. Assumedly, my $1,000 is still worth a $1,000, isn’t it? No it’s not, it’s now worth $813.

WTF? I feel robbed. How it this possible?

This is because of something called inflation.

Inflation is, in essence, the erosion of the value of money.

Inflation creates the illusion that things are more valuable, when in reality they’ve lost some value. If you are a Starbucks, someone who used to pay you $2 for Coffee (me) now pays $4. But it really means that it takes $4 to buy something that I used to be able to obtain for $2. So I have to work twice as hard or earn twice as much to afford that same Coffee in order to not be worse off. Whether it’s Coffee, Houses, Stocks, everything is impacted by inflation.

But where does it come from? Who makes inflation?

The government does.

Huh?

Every month, the government says what inflation is. It reports it publicly, based on it’s own measurements and estimates. It wants inflation to be around 2% per year. Magically, it achieves that number over long periods of time- 10 years, 20 years, according to its reports. It things that creates stability.

What 2% really does is it slowly is letting the air out of the balloon so that it’s not noticeable. And that balloon is your wallet.

Stay with me here.

You bought a house in 2000 for $100,000. According to averages, that house is now worth $325,000. Great! You’re up 225%.

You invested $100,000 in the S&P 500 index at the same time and today that investment is now worth $601,362. That’s an increase, with dividends of 501%! You are a genius aren’t you? The next Warren Buffett.

You have a $100,000 salary in 2000 that has stayed flat because you’re at the top of your scale. You’re still making the same, but somehow you feel worse off.

What does the government say about inflation? The cumulative rate of inflation was 82.7% from 2000 to now. In plain terms, it takes $1.83 to buy what you used to be able to buy for $1.00, on average. Or your $100,000 salary from 2000 now only buys $17,000 worth of stuff today.

That house that you live in isn’t really worth more. It’s just that it now takes $325k to buy it, when it used to be had for $100k. So are you really ahead?

What about the stock investment, it must still be worth something. Well, yes, it’s worth $322k in 2000 money, which is up 233%, or 4.9% per year. Not bad, but 5% isn’t lighting the world on fire.

Why would the government want you to fall behind, to make your Dollar go less far, to erode the value of your savings?

It has to. You see, in making a Dollar less valuable over time, it’s helping itself out. Not only does inflation erode buying power, it makes it easier to pay off old debts, and the U.S. has lots of debt and keeps issuing more.

Back to my Treasury note example, when I loaned the government $1,000, it essentially paid me back $813, when you measure it in 5 years-ago money. The inflation that took place made that old debt less of a burden, which is good for the government and bad for me.

The government needs inflation. It has to have it. But it’s fucking us up.

If you do the maths, just to stay in place, you have to move faster than the rate inflation. To get ahead, you have to move much faster than inflation.

It also means that you want to be in debt in an inflationary environment because you can pay it back later with less valuable money. And you want to own things that can’t be taxed because the government is making up the increase in value, it’s not real.

So what do you do?

Make as much money as possible, so that this devaluation, inflation, doesn’t impact your life.

That’s the only real answer.

Leave a Reply